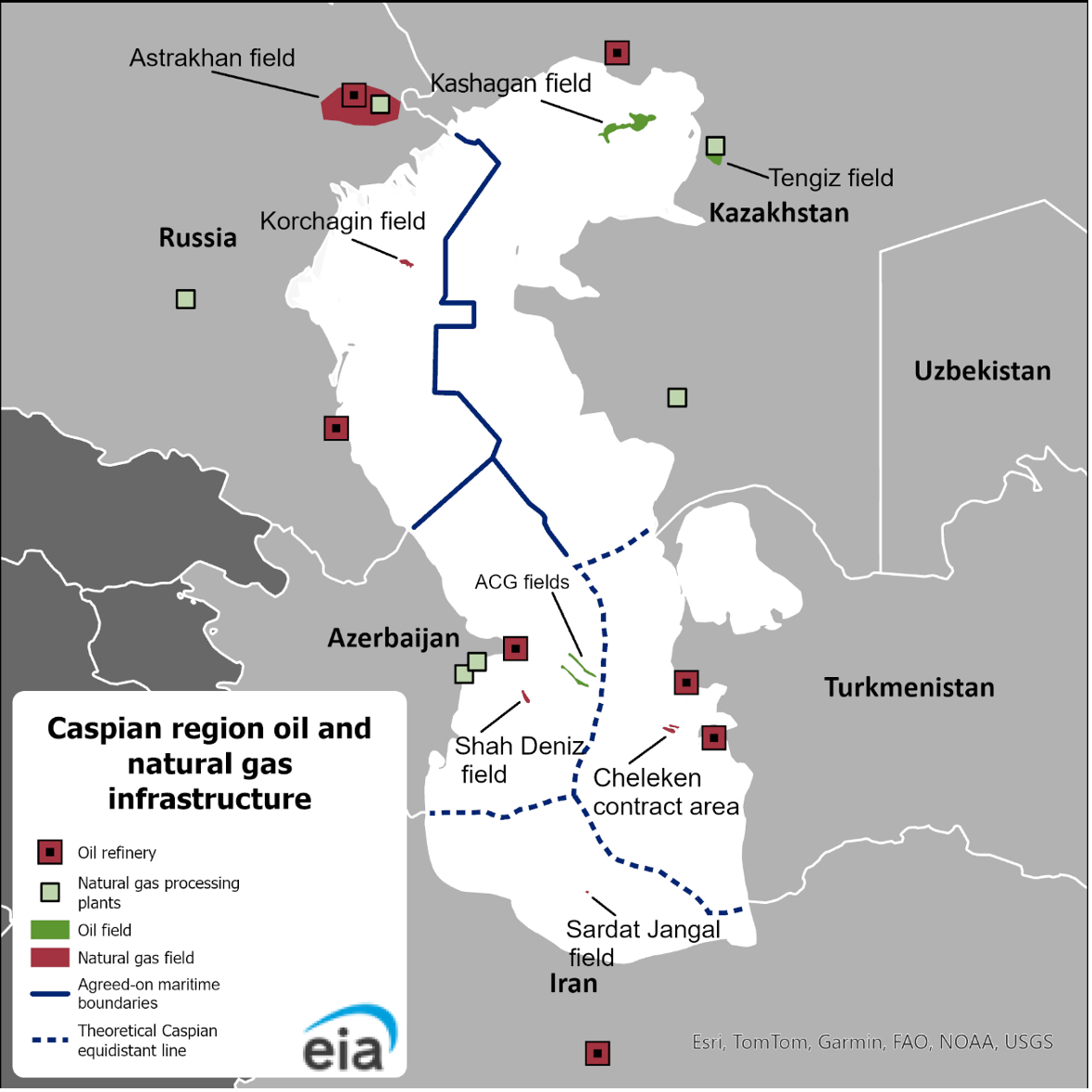

Some weeks ago, the US Department of Energy released an updated survey on the oil and gas sector in the Caspian Basin (US Energy Information Administration, Regional Analysis Brief: Caspian Sea, Last Updated: February 6, 2025). This survey represents a useful analytic tool to understand the current and future trends concerning hydrocarbon reserves potential, the vulnerability of the existent routes of exports, as well as the feasibility of new pipeline projects to enhance the strategy of diversification backed by the post-Soviet Caspian producers (Azerbaijan, Kazakhstan, Turkmenistan), as a key element to boost their energy security condition.

The updated estimates about Caspian oil and gas reserves confirm the role of the basin as a reliable supplier for the consumer markets, mainly European and Chinese but potentially expanding to South Asia. Among the three post-Soviet states, Kazakhstan holds the largest proven oil reserves (30 billion barrels), while Turkmenistan has the world’s fifth largest proved natural gas reserves (after Russia, Iran, Qatar and the USA) estimated at 11,3 trillion cubic metres (tcm). However, the concrete impact of oil and gas potential has to be tailored to the production levels and the possibility of developing multiple (and diversified routes of exports.

Concerning the oil sector, we can observe that Azerbaijan’s oil production has decreased from nearly 1 million barrels per day (b/d) in 2010 to 600.000 barrels b/d in 2024. This shift can be explained by a growing attention to the development of the most profitable gas sector. This element is not the only issue for Azerbaijan’s oil sector. Indeed, 83% of exports are delivered through the Baku-Tbilisi-Ceyhan (BTC) pipeline to the European markets, and the remaining volumes to Russia, underlining a condition of vulnerability because of the lack of diversification options.

For instance, in 2023 the BTC pipeline was stopped for six days following the earthquake in Türkiye. Likewise, Kazakhstan, which produces 1,5 million b/d and exports 1,3 million b/d, is dependent on a main single export route (the Caspian Pipeline Consortium, CPC) which carries 80% of Kazakh crude oil exports crossing Russian territory to the port of Novorossiysk in the Black Sea.

However, Astana also exports the remaining oil to China and the EU through the BTC, but these diversification’s options should be further expanded to reduce the reliance on Russian territory transit, mainly after tensions with Moscow after 2022.